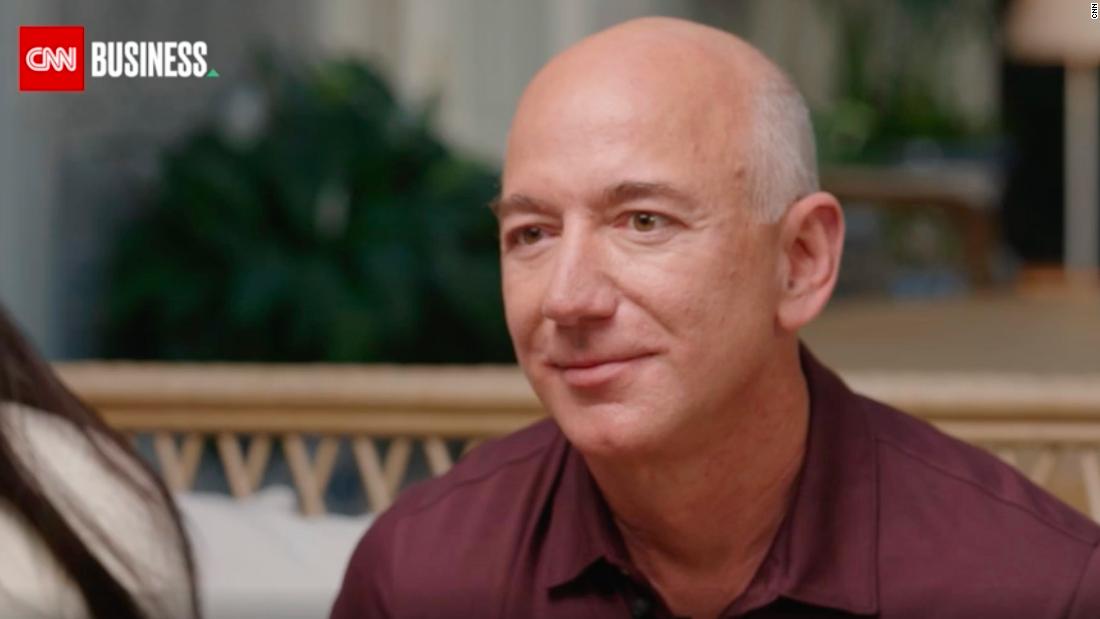

The industry chief presented his starkest recommendation but on a faltering financial system in an unique sit-down interview with CNN’s Chloe Melas on Saturday at Bezos’ Washington, DC, house.

Bezos recommended other folks to get rid of expenditures for big-ticket pieces equivalent to new automobiles, televisions and home equipment, noting that delaying massive purchases is the surest strategy to stay some “dry powder” within the match of a chronic financial downturn. Meanwhile, small companies might wish to steer clear of making massive capital expenditures or acquisitions all over this unsure time, Bezos added.

If sufficient shoppers practice thru with Bezos’ recommendation, it will imply decrease gross sales for Amazon, the e-commerce massive Bezos based and that created the majority of the billionaire’s wealth.

The New York Times reported Monday that Amazon plans to slash its body of workers, shedding 10,000 employees, the biggest aid within the corporate’s historical past. That’s along with a in the past introduced hiring freeze in its company body of workers. The corporate is 2d handiest to Walmart within the collection of other folks it employs within the United States.

Amazon (AMZN) mentioned in October it expects gross sales for the general 3 months of the 12 months to be considerably under Wall Street’s expectancies. The weaker forecast got here as emerging inflation and looming recession fears weigh on client buying choices as Americans focal point extra on commute and eating out and no more on purchasing discretionary items.

The corporate’s inventory has fallen greater than 40% as surging costs and converting buyer conduct weigh on Amazon and the wider tech sector.

Bezos mentioned the chance of financial prerequisites worsening makes it prudent to avoid wasting money if it is an choice.

“Take some risk off the table,” he mentioned. “Just a little bit of risk reduction could make the difference.”

Last month, Bezos tweeted a caution to his fans on Twitter, recommending that they “batten down the hatches.” The recommendation was once supposed for industry homeowners and shoppers alike, Bezos mentioned within the interview.

Many could also be feeling the pinch now, he added, however argued that as an optimist he believes the American Dream “is and will be even more attainable in the future” — projecting that inside his personal lifetime, area commute may grow to be extensively available to the general public.

Although the USA financial system isn’t, technically, in a recession, just about 75% of most likely citizens in a up to date CNN ballot mentioned they really feel as even though it’s. Wages are up, however now not sufficient to take the edge off inflation, maximum particularly prime costs of requirements like meals, gasoline and safe haven. For the ones invested in shares, it is not been a perfect 12 months, both, and that is the reason particularly arduous on retirees who’re residing off their investments.

Other industry leaders have issued equivalent messages concerning the financial system in contemporary months. Tesla (TSLA) and Twitter CEO Elon Musk remaining month admitted call for for Teslas was once “a little harder” to come back by means of, and famous that Europe and China are experiencing a “recession of sorts.” Musk additionally warned that Tesla would fall in need of its gross sales enlargement goal.

JPMorgan Chase CEO Jamie Dimon in October spooked the inventory marketplace by means of pronouncing a recession may hit the United States in as low as six to 9 months.