A gaggle of US economists have gained awarded the Nobel Prize in Economics for his or her paintings on banking’s position within the economic system and keeping off collapses all through monetary crises.

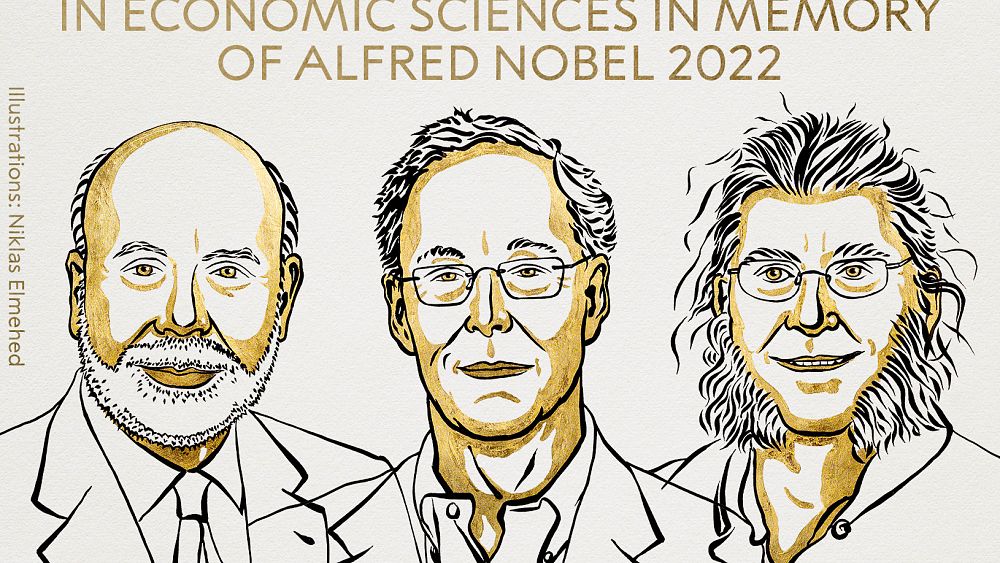

Ben Bernanke, the previous head of the United States Federal Reserve, used to be one of the most recipients.

He will break up the money award of €926,680 (10 million Swedish kronor) with Douglas W. Diamond and Philip H. Dybvig.

Bernanke studied how the Great Depression within the Nineteen Thirties reworked from a somewhat unusual recession into “the worst economic crisis in modern history”.

He found that bank runs — when panicked customers withdraw their savings en masse – can cause banks to collapse.

Diamond and Dybvig were also honoured for their work on bank runs and explaining “why banks exist and how their role in society makes them vulnerable to rumours about their impending collapse”.

And they discovered that governments can save you financial institution runs through offering deposit insurance coverage.

“For the everyday person, this prize gives us the tools to reduce the risks in the financing sector and therefore to avoid financial crisis with a much better understanding of what the regulator has to look at nowadays,” stated Christofer Edling, a member of the Royal Swedish Academy of Sciences.

The trio’s paintings persisted a real-life check all through the 2007-2008 monetary disaster.

At the time, Bernanke used to be the top of the Federal Reserve and he labored with the United States Treasury Department to prop up primary banks and straightforwardness a scarcity of credit score.

He diminished temporary rates of interest to 0, directed the Fed’s purchases of Treasury and loan investments and arrange lending programmes.

And whilst his paintings didn’t save you the recession that adopted, it’s credited with keeping off some other melancholy.

The economists will obtain their prize cash on 10 December. Unlike the opposite Nobel Prizes, the economics award used to be now not established through Alfred Nobel in his will.

The Swedish central financial institution as an alternative created it in 1969.