Our purpose right here at Credible Operations, Inc., NMLS Number 1681276, known as “Credible” under, is to provide the gear and self assurance you wish to have to toughen your funds. Although we do advertise merchandise from our spouse lenders who compensate us for our products and services, all evaluations are our personal.

Check out the loan charges for Mar. 1, 2023, that are in large part unchanged from the day before today. (Credible)

Based on information compiled via Credible, loan charges for house purchases have fallen for one key time period and remained unchanged for 3 different phrases since the day before today.

Rates remaining up to date on Mar. 1, 2023. These charges are in line with the assumptions proven right here. Actual charges would possibly range. Credible, a non-public finance market, has 5,000+ Trustpilot evaluations with a median megastar score of four.7 (out of a conceivable 5.0).

What this implies: Mortgage charges for house purchases edged down these days for 15-year charges, whilst charges for all different phrases held secure. Borrowers who desire a smaller per thirty days loan fee would possibly need to imagine 30-year charges, that have held secure for 3 instantly days. But debtors who need to decrease pastime prices will to find better pastime financial savings with 10- or 15-year charges. Buyers would possibly need to lock in a low charge these days whilst charges for all reimbursement phrases are nonetheless underneath 7%.

To to find nice loan charges, get started via the usage of Credible’s secured website online, which will display you present loan charges from a couple of lenders with out affecting your credit score ranking. You too can use Credible’s loan calculator to estimate your per thirty days loan bills.

Based on information compiled via Credible, loan refinance charges have risen for one key time period and remained unchanged for 3 different phrases since the day before today.

Rates remaining up to date on Mar. 1, 2023. These charges are in line with the assumptions proven right here. Actual charges would possibly range. With 5,000 evaluations, Credible maintains an “excellent” Trustpilot ranking.

What this implies: Mortgage refinance charges edged up these days for 15-year phrases, whilst charges for all different reimbursement phrases held secure. Still, householders will to find better pastime financial savings with 15-year charges, which stay the bottom to be had at 5.875%. But householders who need to refinance into an extended reimbursement time period would possibly need to imagine a 20-year refinance. At 6%, a 20-year time period gives a fascinating mix of a fairly low charge and smaller per thirty days bills.

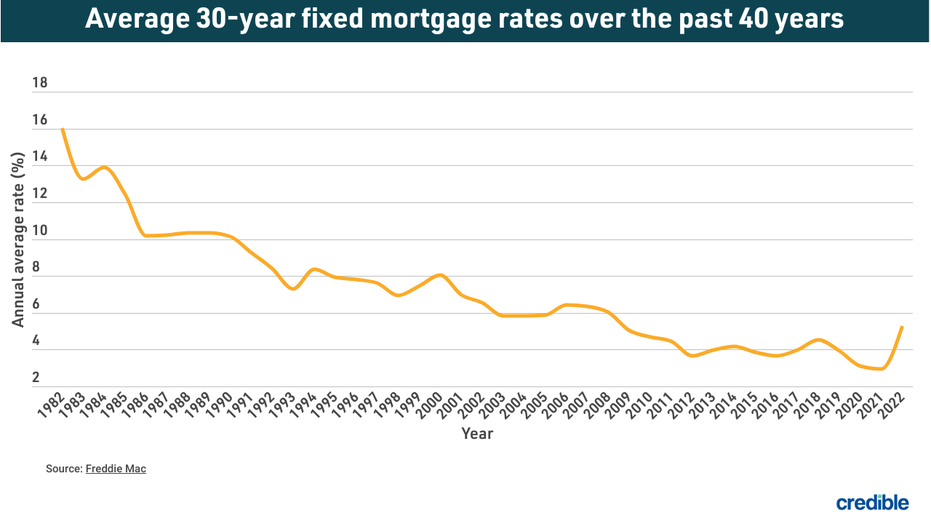

How loan charges have modified through the years

Today’s loan rates of interest are smartly under the absolute best annual moderate charge recorded via Freddie Mac — 16.63% in 1981. A yr earlier than the COVID-19 pandemic upended economies internationally, the common rate of interest for a 30-year fixed-rate loan for 2019 was once 3.94%. The moderate charge for 2021 was once 2.96%, the bottom annual moderate in 30 years.

The ancient drop in rates of interest method householders who’ve mortgages from 2019 and older may doubtlessly understand vital pastime financial savings via refinancing with considered one of these days’s decrease rates of interest. When making an allowance for a loan refinance or acquire, it’s necessary to bear in mind ultimate prices corresponding to appraisal, utility, origination and lawyer’s charges. These components, along with the rate of interest and mortgage quantity, all give a contribution to the price of a loan.

How Credible loan charges are calculated

Changing financial stipulations, central financial institution coverage selections, investor sentiment and different components affect the motion of loan charges. Credible moderate loan charges and loan refinance charges reported on this article are calculated in line with data supplied via spouse lenders who pay repayment to Credible.

The charges think a borrower has a 740 credit score ranking and is borrowing a traditional mortgage for a single-family house that shall be their number one place of abode. The charges additionally think no (or very low) bargain issues and a down fee of 20%.

Credible loan charges reported right here will most effective provide you with an concept of present moderate charges. The charge you in truth obtain can range in line with various components.

How a lot can I borrow for a loan?

It’s essential to have an concept of ways a lot you’ll be able to come up with the money for to borrow for a loan earlier than you start house buying groceries or make an be offering on a space.

Generally, the 28/36 rule is a great measure of ways a lot you’ll be able to come up with the money for to borrow with out strapping your funds. The rule states that your loan fee, together with taxes and insurance coverage, shouldn’t be greater than 28% of your gross per thirty days source of revenue. And all of your money owed, together with your loan and different per thirty days bills like automotive and pupil mortgage bills, shouldn’t exceed 36% of your gross per thirty days source of revenue.

For instance, in case your gross per thirty days source of revenue is $6,250 (annual wage of $75,000), you will have to be capable to come up with the money for a per thirty days fee of $1,750. And your overall per thirty days debt load shouldn’t exceed $2,250.

A common rule of thumb is that you simply shouldn’t take out a loan that’s two to 2 and part instances your gross annual source of revenue. So within the above situation, the utmost you will have to borrow to shop for a space could be $187,500.

Ultimately, lenders resolve how a lot you’ll be able to come up with the money for to borrow via weighing your source of revenue, debt, property, credit score and different monetary components.

If you’re looking for the fitting loan charge, imagine the usage of Credible. You can use Credible’s loose on-line software to simply evaluate a couple of lenders and notice prequalified charges in only a few mins.

Have a finance-related query, however have no idea who to invite? Email The Credible Money Expert at moneyexpert@credible.com and your query may well be spoke back via Credible in our Money Expert column.