Our objective right here at Credible Operations, Inc., NMLS Number 1681276, known as “Credible” underneath, is to provide the gear and self assurance you wish to have to make stronger your budget. Although we do advertise merchandise from our spouse lenders who compensate us for our products and services, all reviews are our personal.

Check out the loan charges for August 12, 2022, that are up from the day past. (Credible)

Based on information compiled by way of Credible, loan refinance charges have risen throughout all phrases since the day past.

Rates closing up to date on August 12, 2022. These charges are in response to the assumptions proven right here. Actual charges would possibly range. With 5,000 critiques, Credible maintains an “excellent” Trustpilot ranking.

What this implies: Mortgage refinance charges surged by way of 1 / 4 level or extra throughout all compensation phrases lately. With lately’s will increase, householders having a look to refinance would possibly wish to believe refinancing to a 15-year time period. This mid-length compensation time period provides the combo of a moderately low rate of interest and manageable per thirty days bills, and lets in householders to be mortgage-free faster.

Today’s loan charges for house purchases

Based on information compiled by way of Credible, loan charges for house purchases have risen throughout all phrases since the day past.

Rates closing up to date on August 12, 2022. These charges are in response to the assumptions proven right here. Actual charges would possibly range. Credible, a non-public finance market, has 5,000+ Trustpilot critiques with a mean big name ranking of four.7 (out of a imaginable 5.0).

What this implies: Rates for house purchases spiked throughout all compensation phrases lately. Buyers who can swing a bigger per thirty days cost may believe a 15- or 10-year loan, which closed the week at 5.25%.

To to find nice loan charges, get started by way of the use of Credible’s secured web page, which is able to display you present loan charges from a couple of lenders with out affecting your credit score ranking. You too can use Credible’s loan calculator to estimate your per thirty days loan bills.

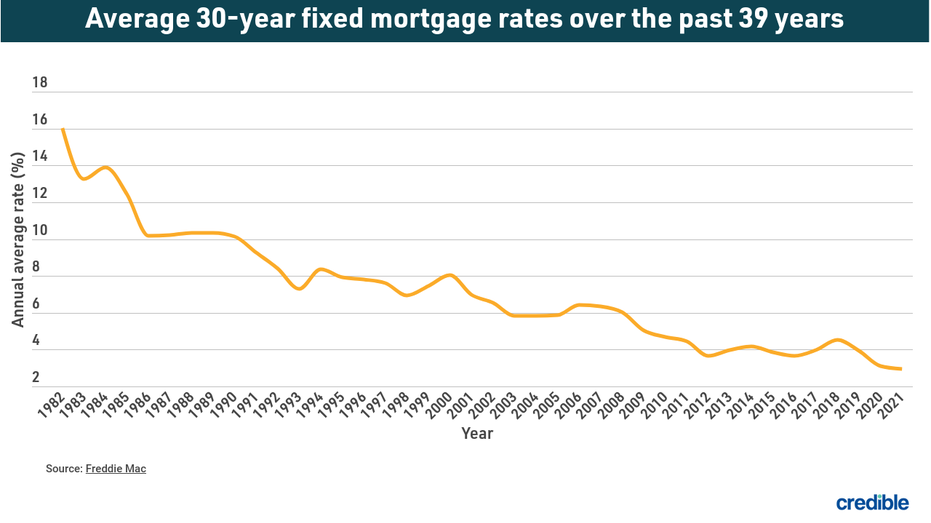

How loan charges have modified through the years

Today’s loan rates of interest are neatly underneath the absolute best annual moderate charge recorded by way of Freddie Mac – 16.63% in 1981. A yr sooner than the COVID-19 pandemic upended economies the world over, the typical rate of interest for a 30-year fixed-rate loan for 2019 was once 3.94%. The moderate charge for 2021 was once 2.96%, the bottom annual moderate in 30 years.

The historical drop in rates of interest manner householders who’ve mortgages from 2019 and older may probably notice important passion financial savings by way of refinancing with one in every of lately’s decrease rates of interest. When taking into account a loan refinance or acquire, it’s vital to keep in mind ultimate prices akin to appraisal, software, origination and lawyer’s charges. These components, along with the rate of interest and mortgage quantity, all give a contribution to the price of a loan.

Are you having a look to shop for a house? Credible mean you can examine present charges from a couple of loan lenders directly in only some mins. Use Credible’s on-line gear to match charges and get prequalified lately.

Thousands of Trustpilot reviewers charge Credible “excellent.”

How Credible loan charges are calculated

Changing financial prerequisites, central financial institution coverage selections, investor sentiment, and different components affect the motion of loan charges. Credible moderate loan charges and loan refinance charges reported on this article are calculated in response to data supplied by way of spouse lenders who pay repayment to Credible.

The charges suppose a borrower has a 740 credit score ranking and is borrowing a traditional mortgage for a single-family house that can be their number one place of abode. The charges additionally suppose no (or very low) bargain issues and a down cost of 20%.

Credible loan charges reported right here will handiest provide you with an concept of present moderate charges. The charge you in fact obtain can range in response to a variety of components.

How do I am getting a loan?

When you’re able to shop for a house, you must lock down your loan choices sooner than you start space looking. Having your financing covered up could make the method pass smoother, and provide you with a leg up on different patrons who’ve now not but been prequalified or pre-approved for a loan.

Here are the overall steps to getting a loan:

- Get a care for for your budget and credit score. Add up your general per thirty days bills and subtract them out of your general per thirty days source of revenue to peer how a lot you might be able to spend on a per thirty days loan cost. Check your credit score ranking and report back to proper any mistakes for your file and take motion if you wish to have to make stronger your credit score ranking.

- Get pre-approved for a loan. Although pre-approval doesn’t ensure the lender provides you with a loan, it’s a robust indication you’ll be capable to qualify for one when the time comes. Having a pre-approval letter could make your be offering extra sexy to possible dealers.

- Comparison store. Once you’ve had an be offering permitted at the space of your desires, it’s time to match charges from a couple of loan lenders. Be positive to match all of the prices of a loan, now not simply the rate of interest.

- Complete the overall software. You’ll wish to supply detailed details about your source of revenue, financial savings, per thirty days bills, and general monetary state of affairs.

If you’re looking for the correct loan charge, believe the use of Credible. You can use Credible’s unfastened on-line device to simply examine a couple of lenders and notice prequalified charges in only some mins.

Have a finance-related query, however do not know who to invite? Email The Credible Money Expert at moneyexpert@credible.com and your query may well be replied by way of Credible in our Money Expert column.

As a Credible authority on mortgages and private finance, Chris Jennings has coated subjects that come with loan loans, loan refinancing, and extra. He’s been an editor and editorial assistant within the on-line private finance area for 4 years. His paintings has been featured by way of MSN, AOL, Yahoo Finance, and extra.