FOX Business host Stuart Varney argues Biden does not need to “admit” that inflation is top forward of the midterms.

While some individuals of the Biden management spent their Wednesday celebrating an 8.5% year-over-year inflation price for July, one former Democratic U.S. Treasury secretary expressed slightly extra skepticism.

“Historically, every time we have had unemployment below four and inflation above four, we have had a recession within the next two years […], so the odds that the exit from this will involve […] a completely soft landing are, I think, quite low,” stated former Treasury Secretary Larry Summers at an Aspen Institute tournament titled, “Is the U.S. headed for stagflation?” this week.

Summers briefly recognized a root reason for the document inflation: executive spending.

“We basically had inflation under control for 40 years […] we lost the thread, along with many other countries about a year and a half ago, with massive expansionary policies relative to the size of the GDP gap,” the previous National Economic Council director below President Obama remarked.

Former Treasury secretary and White House financial consultant Larry Summers is interviewed through FOX News’ Maria Bartiromo at FOX Studios on May 24, 2017, in New York City. (Robin Marchant/Getty Images / Getty Images)

STUART VARNEY ON BIDEN’S ‘ZERO’ INFLATION CLAIM: WE KNOW WE’RE WORSE OFF, DESPITE WHAT THE PRESIDENT SAYS

“The fiscal stimulus was five times as large as it had been during the financial crisis and at the same time massively accommodative monetary policies […] the consequence is that we now have a very substantial inflation rate,” the Harvard economist added.

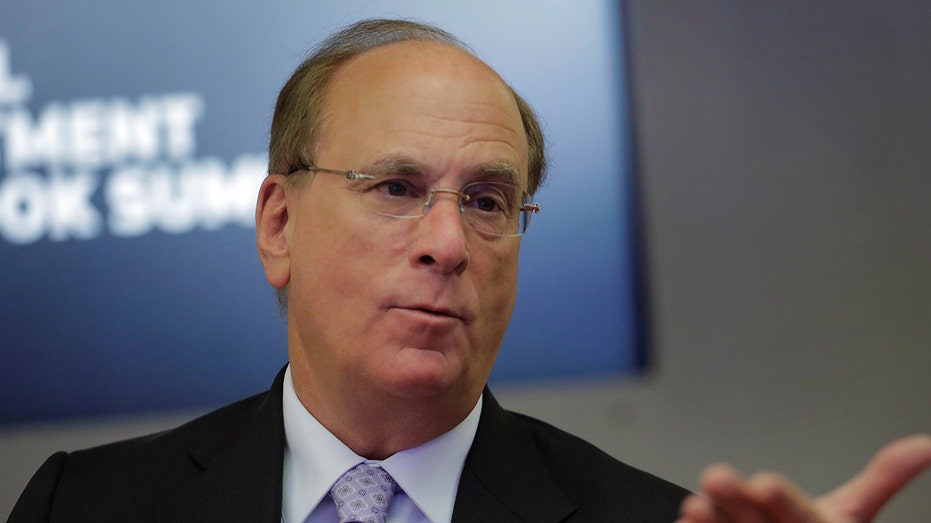

However, one member at the panel, BlackRock chairman and CEO Larry Fink, disagreed with Summers’ overview of the issue.

“From my vantage point, the recession is not just because of aggressive monetary policy. The inflation that we’re facing is so much policy-oriented. Our policies of movement away from consumerism to populism is inflationary, and policies have been built around those, you know, the domestic issues that we have today,” Fink commented.

The billionaire businessman claimed {that a} loss of felony immigration used to be a vital driving force of inflation.

“More importantly, we’ve eliminated a large component of legal immigration […] one of the reasons why we have such job needs, we have 10 and a half million job openings right now and 5 million unemployed. So, we have this mismatch,” the BlackRock founder stated.

Laurence Fink, founder and leader government officer of BlackRock Inc., speaks all over the Reuters Global Investment Outlook Summit in New York on Nov. 13, 2017. (Reuters/Lucas Jackson / Reuters Photos)

CONCHA BLASTS BIDEN’S ‘LAUGHABLE’ INFLATION ASSERTION

Fink used the ground to suggest for a transformation in U.S. coverage to assist inflation.

“We’re seeing rising wages across the board […] and so all these issues are confronting us and these issues are not going to go away when the Federal Reserve tightens because these are policy-oriented issues. And if we just put all the pressure on our central bank and every other central bank, we may put the economy into a recession. We may bring down some inflation, but some of this inflation that we have can only change if we change policies,” he added.

Whereas some at the panel had been constructive concerning the common outlook of the U.S. financial system, one panelist who expressed doubt used to be Minneapolis Federal Reserve President Neel Kashkari.

Referring to the day prior to this’s CPI numbers, Kashkari stated, “I’ll welcome — I’ll take it, but far, far, far away from declaring victory. I mean, this is just the first hint that maybe inflation is starting to move in the right direction, but it doesn’t change my path.”

Like Summers, Kashkari additionally conveyed worry a couple of conceivable U.S. recession.

Minneapolis Federal Reserve President Neel Kashkari warned that the present state of inflation is “very concerning” and continues to “spread out more broadly across the economy” all over an look on CBS’ “Face The Nation” on July 31, 2022. (John Lamparski/Getty Images / Getty Images)

“I think the transition from where we are in this high inflation environment to [a pre-COVID world] is not going to be linear […] we may be in a recession in the near future. You know, I don’t know yet, but I agree with Chair Powell. We’re going to do our best to avoid it,” the Minneapolis Fed authentic persisted.

CLICK HERE TO READ MORE FROM FOX BUSINESS

Discussing a conceivable recession, Summers cautioned that executive authentic alerts that inflation used to be transitory closing 12 months being mistaken don’t assist the location.

“I think one of the reasons why we have some of the deep problems we do of lack of faith in public institutions is that people have just wanted to make [other] people happy. And so they give optimistic forecasts because they think it’s good to inject confidence into the situation, and that’s kind of a short-sighted thing,” he stated.

And as for whether or not Summers believes a cushy touchdown is certainly conceivable?

“History teaches something quite clearly, and that is that soft landings represent what George Bernard Shaw said of second marriage: the triumph of hope over experience. We just don’t have them,” the previous Treasury secretary below President Clinton analogized.