GMC & Buick international vice chairman Duncan Aldred discusses the ‘strong point’ of GMC’s Hummer electrical truck on ‘The Claman Countdown.’

DETROIT -General Motors Co. stocks jumped early on Tuesday after it reported increased web source of revenue for the fourth quarter, forecast stronger-than-expected income for 2023 and mentioned it will lower $2 billion in prices.

The automaker, the highest within the U.S. via gross sales, forecast that it might cling its pre-tax margins stable between 8% and 10% via 2025, regardless of a price cutting war that Tesla Inc has brought about within the electrical car section.

GM plans to construct best about 400,000 electrical cars in North America between now and the primary part of 2024. Its monetary effects will hinge principally on gross sales of combustion-engine vehicles and SUVs.

For now and for a number of years yet to come, GM’s profitability can be pushed via call for for the ones cars – a truth GM highlighted in its presentation to traders. GM underscored that its Chevrolet and GMC pickup vehicles make it No. 1 in gross sales quantity within the U.S. marketplace, and it leads in gross sales of extremely winning massive SUVs as smartly.

GM’s outlook “sets a high bar for this year,” Morgan Stanley analyst Adam Jonas wrote in a notice. Jonas mentioned GM expects to spice up earnings over a length when different legacy automakers’ revenues may just shrink.

“We question whether the company will be able to self-fund such spending plans in a higher rate, slower growth environment,” Jonas wrote.

COST CUTS

The corporate plans to chop prices in automobile operations via $2 billion this yr, together with lowering employment via attrition, Chief Financial Officer Paul Jacobson informed newshounds on a choice on Tuesday, however does now not plan layoffs. Big generation companies together with Amazon, Google and Microsoft have rattled markets via pronouncing hundreds of task cuts.

GM has 167,000 workers international, together with its monetary subsidiary and the Cruise robotaxi unit.

Jacobson mentioned the U.S. car marketplace remained powerful, and the automaker forecast U.S. automobile and lightweight truck gross sales will upward push in 2023 to fifteen million cars from 13.9 million remaining yr.

Jacobson expressed little fear concerning the attainable affect of new value cuts via Tesla and Ford Motor Co on standard electrical car fashions.

“We see incredibly strong demand with the pricing strategy we’ve gone to market with,” Jacobson mentioned.

EV value cuts shouldn’t impact pricing for GM’s combustion cars, he mentioned. The upbeat forecast from GM cheered traders, who despatched the automaker’s stocks up 5% in premarket buying and selling.

GM expects constant power in its core auto operations in 2023, with full-year working income within the vary of $10.5 billion to $12.5 billion, or $6.00-$7.00 a proportion. Analysts had anticipated $5.73 a proportion, consistent with Refinitiv IBES information.

For 2022, GM’s working benefit dropped to a report $14.5 billion.

In the fourth quarter, GM earned $2 billion, up from $1.7 billion the former yr, as increased costs and larger gross sales quantity in North America greater than offset increased prices.

Operating income in step with proportion of $2.12 within the quarter when put next with $1.99 a yr previous. Analysts had predicted $1.69.

GM’s moderate car promoting value in North America hit a report $51,000 in 2022, as the corporate centered manufacturing on costlier, higher-margin cars.

GM mentioned capital spending will vary between $11 billion and $13 billion in 2023, up from $9 billion in 2022.

Ahead of the income unencumber, the automaker mentioned it will make investments $650 million in Lithium Americas and collectively increase a lithium mine in Nevada that it says is the biggest identified supply of the important thing battery subject material within the United States.

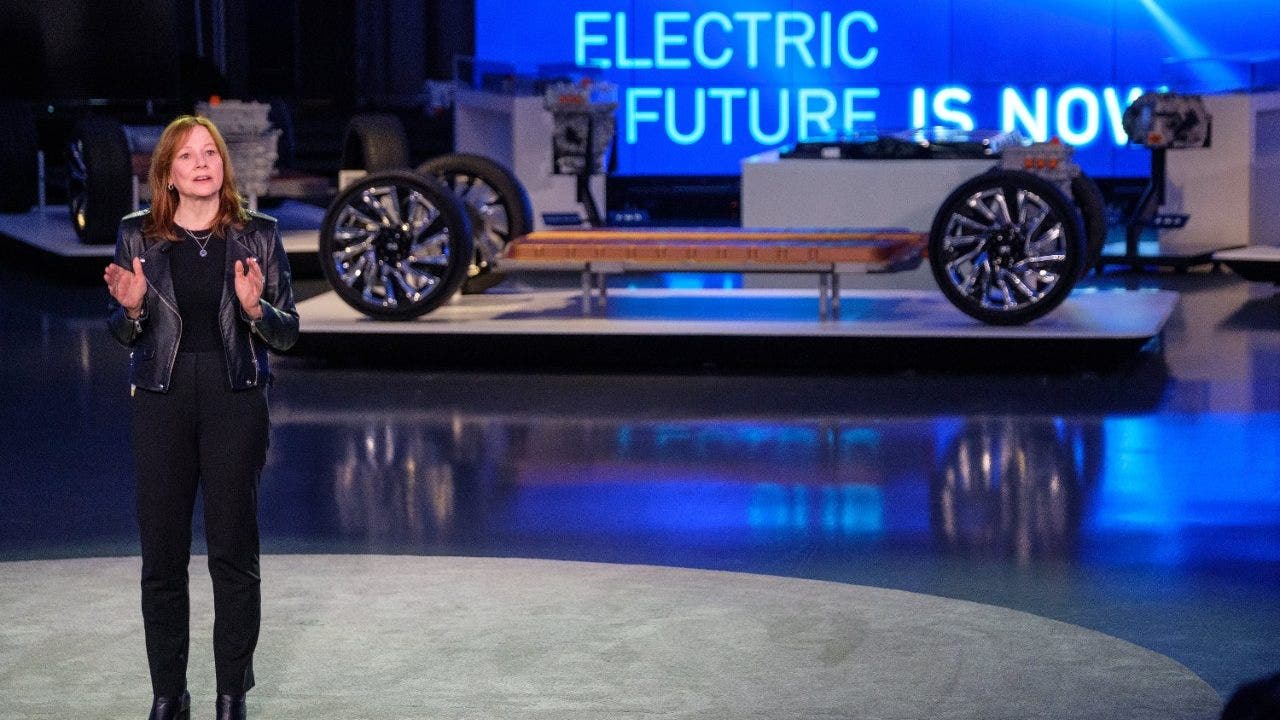

The corporate expects earnings from electrical cars to succeed in $50 billion in 2025 — about 22% of general earnings — with pre-tax margins within the low to mid-single digits.